Add Your Heading Text Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Risk less and get better returns with Goose Droppins AI powered momentum algorithms.

Goose Droppins is an invite only finance tool that targets key stocks for option trades. Are you ready to:

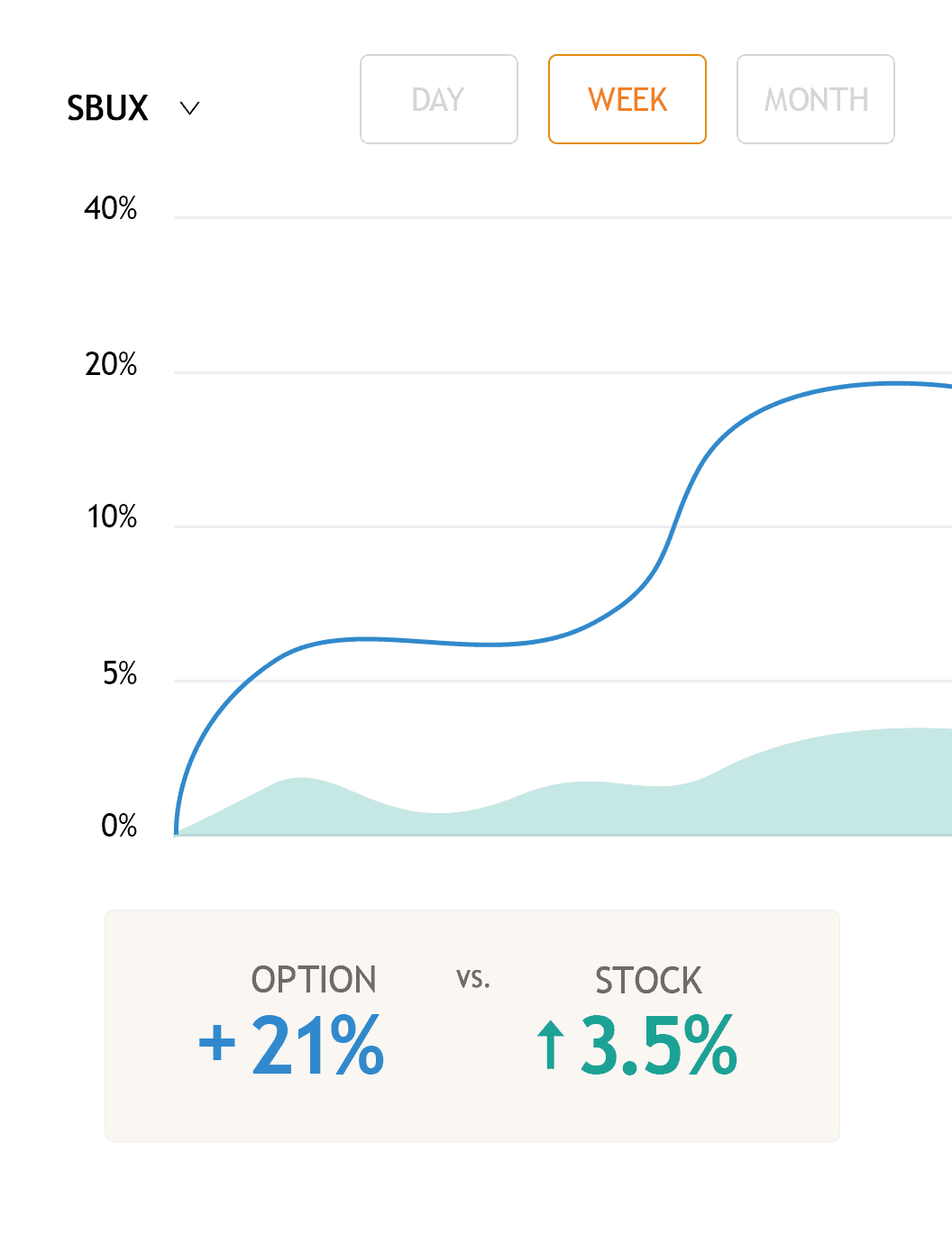

To put this in laymen’s terms, if you invest in the same company (Starbucks) the option will ALWAYS outperform the stock.

Our platform curates and recommends new droppins each month.

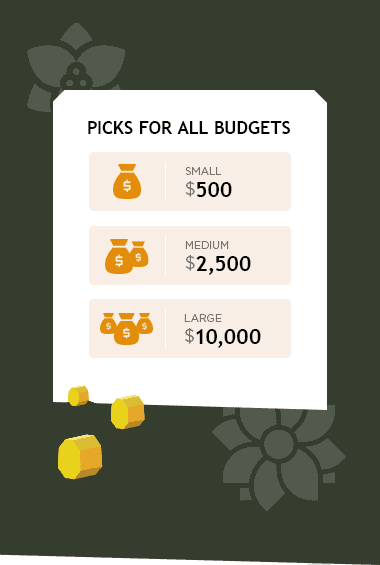

Depending on your investment budget options picks range from $500 to $30,000+.

Your return on investment (ROI) can come quick. Ultimately, you control when to sell.

Sorry our current beta group is now filled. Sign up for future updates.

In order to begin trading you will need a brokerage account with options trading active.

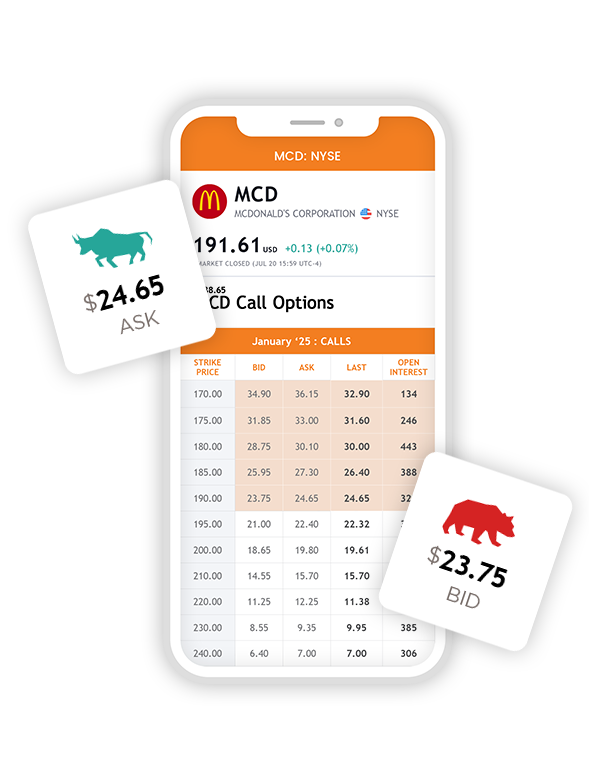

Before you actually buy and take an option position review generated picks for a good fit.

Once you're ready follow our Goose Droppins rules and take your first option position.

Key methods to consider with every trade.

We have talked a lot about huge gains and making tons of money with options. It’s 100% possible, but never guaranteed. Let’s take a quick reality check! Options can go up and down just like stocks. But with options you can lose more faster (just like you can gain more faster). Set your expectations and take your profits or losses accordingly.

The Goose’s Risk Classification Index.

Level | Pros | Win-To-Loss Ratio | Description |

|---|---|---|---|

Low Risk | Leap ITM | 80/20 | In the Money (ITM) leaps are options with an expiration date greater than 1 year and the stock price is less than the option strike price. More time equals less risk. |

Medium Risk | Leap OTM | 60/40 | Out of the money (OTM) leaps are options greater than 1 year, but the stock price is greater than the strike price. This offers zero intrinsic value, greater upside and slightly greater risk. |

High Risk | Non Leap | 40/60 | A non leap is an option that would expire in less than 1 year and could be ITM or OTM. This varies of the level of risk. ITM would have less risk than OTM. |

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.